401k contribution calculator to max out

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit or 27000 year 2022 limit for those 50 years or older in the first few months of the year. By comparison the contribution limit for 2021 was 19500.

The Maximum 401k Contribution Limit Financial Samurai

Learn About 2021 Contribution Limits Today.

. 401k Contribution Calculator To Max Out If you get paid twice per month that works out to be a total 401 k contribution of 800 per month or 9600 per year. Ad Discover The Benefits Of A Traditional IRA. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings.

This number only accounts for the. Maximum deferred employee contributions. Doing the math on the different.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. The calculator includes options for factoring in. It provides you with two important advantages.

401 k Calculator A 401 k can be one of your best tools for creating a secure retirement. This 401 Retirement Calculator will calculate how much your 401 will be worth by the time you reach the age you plan to retire. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

First all contributions and earnings to your 401. If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit. Learn About 2021 Contribution Limits Today.

Select a state to. Plan For the Retirement You Want With Tips and Tools From AARP. Dont Wait To Get Started.

This calculator has been updated to. TIAA Can Help You Create A Retirement Plan For Your Future. Benefit from catch-up contributions.

The good news is employer contributions do not. Input your desired loading period in months annual salary expected bonus and percentage of bonus that will be contributed minimum contribution percentage required for. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

A One-Stop Option That Fits Your Retirement Timeline. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. After age 50 you are able to contribute a total of 26000 each year.

Ad Discover The Benefits Of A Traditional IRA. Max out 401000 employer contributions. State Date State Federal.

A One-Stop Option That Fits Your Retirement Timeline. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. According to the IRS you can contribute up to 20500 to your 401 k for 2022.

Employees 50 or over can make an additional catch-up contribution of 6500. The IRS allows each person to contribute 19500 to their 401k account up until age 50. Many employees are not taking full advantage of their employers matching contributions.

401k Contribution Limits for 2022 - SmartAsset The 401k contribution limit for 2022 is 20500. How do I calculate my 401k max. Employees are allowed to contribute a maximum of 19500 to their 401 in 2020 or 26000 if youre over 50 years of age.

Strong Retirement Benefits Help You Attract Retain Talent. Ad Maximize Your Savings With These 401K Contribution Tips From AARP.

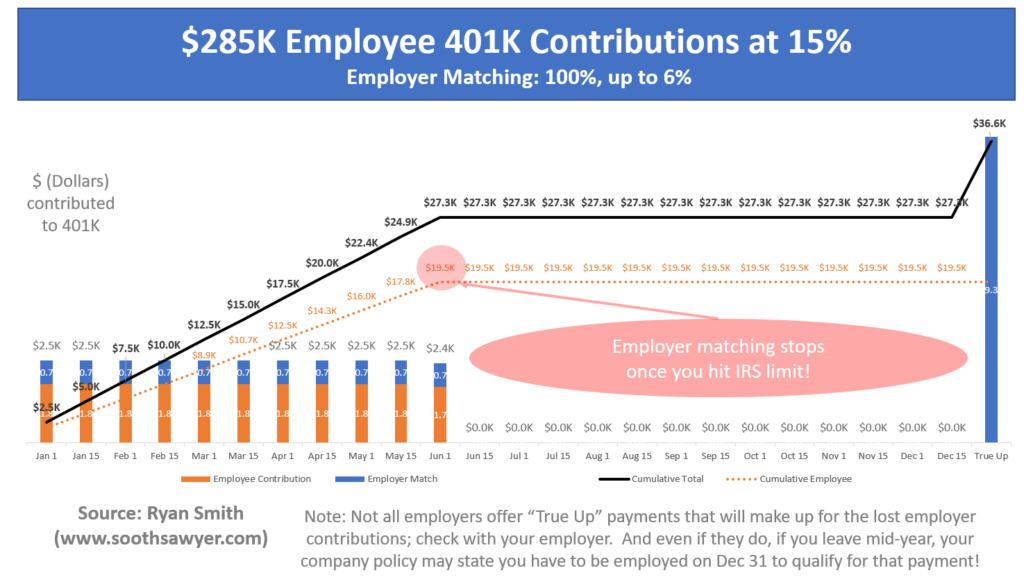

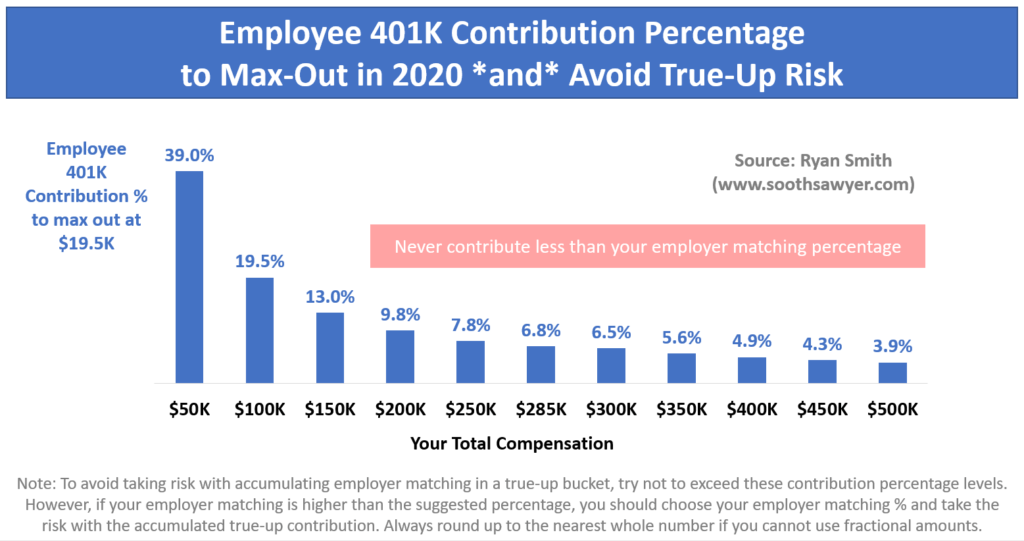

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

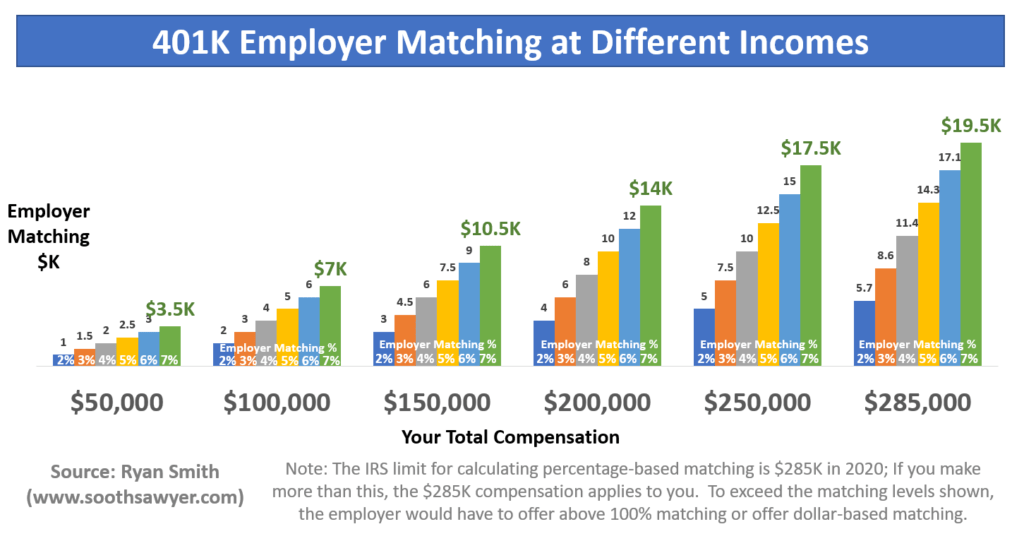

Employer 401 K Maximum Contribution Limit 2021 38 500

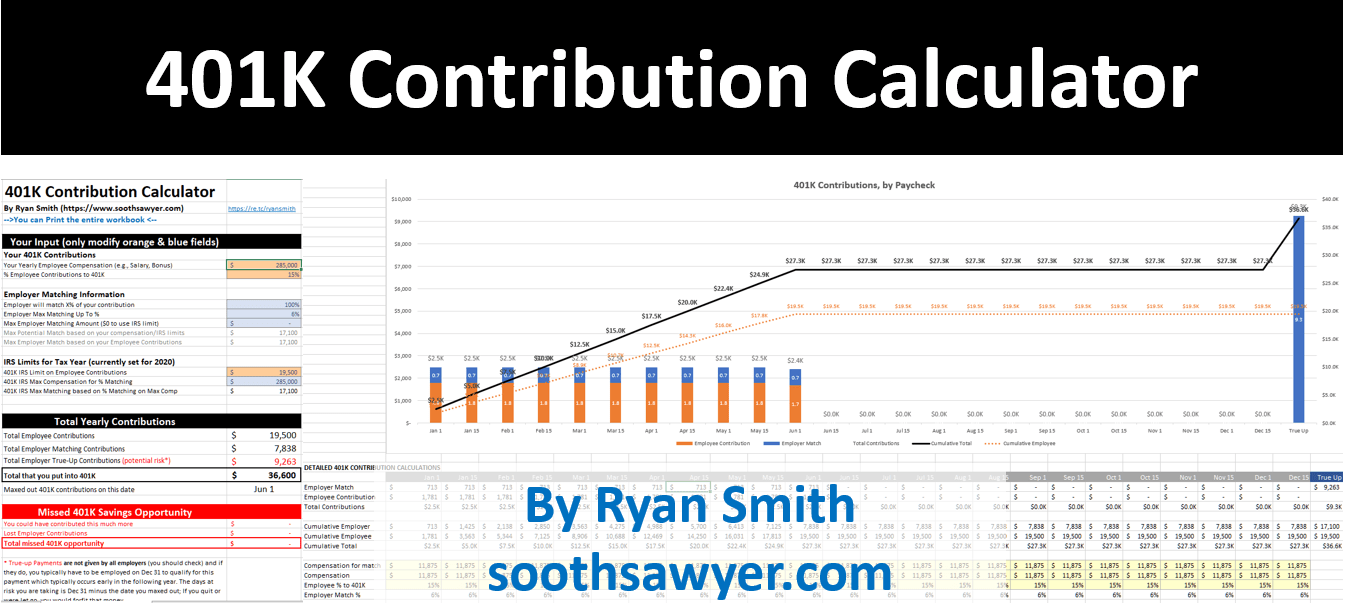

Free 401k Calculator For Excel Calculate Your 401k Savings

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

Solo 401k Contribution Limits And Types

The Maximum 401 K Contribution Limit For 2021

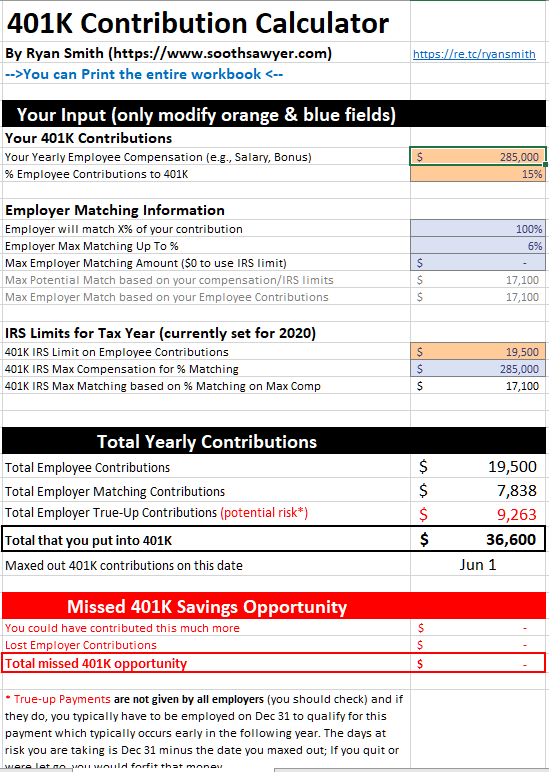

401k Employee Contribution Calculator Soothsawyer

Solo 401k Contribution Limits And Types

401k Employee Contribution Calculator Soothsawyer

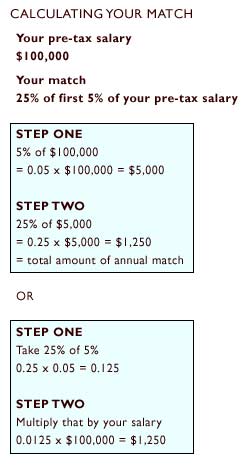

Doing The Math On Your 401 K Match Sep 29 2000

The Maximum 401k Contribution Limit Financial Samurai

401 K Plan What Is A 401 K And How Does It Work

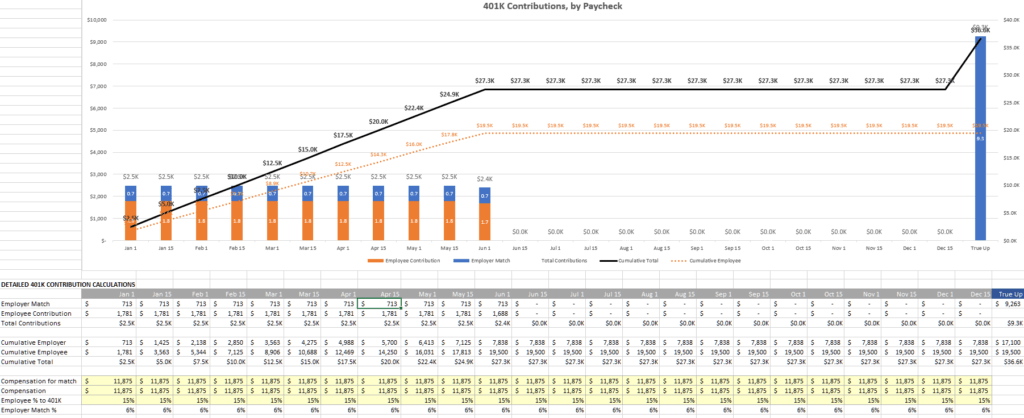

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Solo 401k Contribution Limits And Types

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

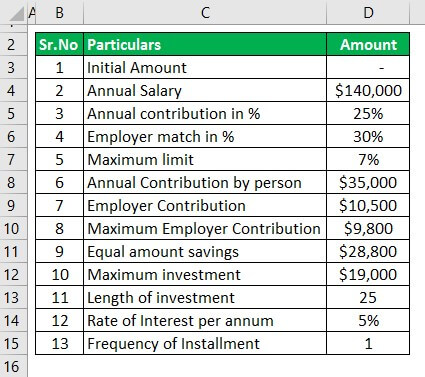

401k Contribution Calculator Step By Step Guide With Examples

401k Employee Contribution Calculator Soothsawyer